Archive for May 2013

Britain’s NGA broadband bill – £6.2bn?

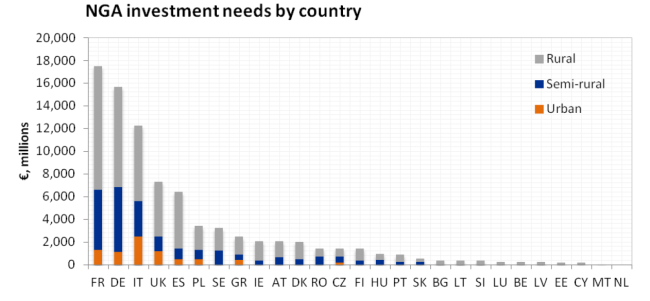

Tucked away in the appendix to Point Topic’s reassessment of the cost of providing 100% next generation broadband access to Europe is the cost to do it for the UK: £6.186bn (€7.304bn).

This is made from €1,157m for urban areas, €1,297m for semi-rural areas, and €4,850m for rural areas.

This is a far cry from the £29bn estimated by rival consultancy Analysys Mason for the Broadband Stakeholders Group, which became government and industry dogma for the cost of ‘fibre-ing up the country’.

Point Topic’s think-piece estimates €60,000 is the total capex cost (including long-distance backhaul for example) of providing universal 30Mbps downloads via VDSL for a single street cabinet that covers a European urban area of radius 700 metres, approximately 1.6km2 in area. The cabinet is assumed to serve all homes in the area up to 600, ie €100 per home. Less than 100% take-up and other inefficiencies probably push this to €150 per home passed, it says. This rises to €900 in semi-rural areas.

The rural areas need a different approach, it says. Point Topic suggests a subsidy of €2,000 per home will do the trick and attract private investment. B4RN, the private FTTH network, expects to connect homes for an average of £1,400.

The analyst further suggests the UK has the smallest rural “challenge”, with just 4.6% of rural homes facing above average or high funding needs.

Point Topic puts the cost to provide every home in the EU with access to a broadband service that offers 30Mbps downloads at €80bn, less than half the usual estimates of €180bn to €270bn.

True, this is not the ‘future-proofed’ fibre to the home (FTTH) B4RN solution, but uses existing copper in the local loop. One suspects that using E-band (>60MHz ‘WiGig’) wireless links instead of copper could also play a role, despite the need for greater beam accuracy and signal attenuation in rain.

Government broadband projects face disaster

The Cabinet Office’s Major Projects report classifies the two main BDUK projects, for next generation access and for “super-connected cities” as Amber/Red, meaning they risk running out of control.

Amber/red means that “successful delivery of the project is in doubt, with major risks or issues apparent in a number of key areas. Urgent action is needed to ensure these are addressed, and whether resolution is feasible”.

The report reveals the “whole life” cost of the NGA roll-out is now £1.8bn. Another £150m for putting in 100Mbps backbone networks in cities is tied up because BT and Virgin Media have questioned the use of state aid to do it.

“As of 25/03/13 the (NGA) 12/13 budget is now £12m and the forecast is £10m. Projected spend in 12/13 is less then originally forecast owing to the delays in gaining State aid. DCMS has agreed a budget re-profile with HMT which has brought the budget profile into line with forecast expenditure,” the report said.

BT Openreach’s Ethernet delivery and repair worsens

BT Openreach’s delivery and repair of Ethernet connections continues to deteriorate, the Office of the Telecommunications Adjudicator (OTA2) reports.

Br0kenTeleph0ne reported earlier that Openreach had suspended a new Ethernet ordering system, Ethernet Access Direct (EAD), on 15 September after communications providers (CPs) had found it didn’t work. EAD is meant to process orders for sub-1Gbps Ethernet connections.

The OTA2 described this as “a disappointing set-back for the Ethernet community”, adding “Given the strategic importance attached to this key development, and the need to ‘get it right’, the decision by Openreach to ‘suspend’ whilst a fundamental re-assessment is undertaken is a decision which is welcomed by the CP community.”

BT said CPs could still place orders through the legacy system that EAD is meant to replace.

In its April report just out, the OTA2 said, “We are still awaiting sight of the plan for restarting the (EAD) programme and CPs are expressing concern that the time taken to get to a clear set of strategic goals for the system and for Openreach to share their thoughts on how any new model will work.”

OTA2 went on to say, “The Ethernet products are experiencing a deteriorating performance – there are problems with the delays in planning and the CPs are reporting increasing frustration with the responsiveness of Openreach in any direct communication (job controller answer times have increased significantly) and the jeopardy and escalation processes don’t seem to be as efficient as needed.”

Problems with Ethernet ordering may also affect perceptions that Openreach ignores the needs of business customers. OTA2 said that during summer (2012) a number of CPs complained to Ofcom that “Openreach was not addressing the needs of business-focused CPs and their customers, leading to unacceptable levels of service for this group of CPs.”

CPs and Openreach started to review possible improvements for copper-based products (WLR, ISDN, MPF and SMPF). “Good progress has been made against the Q1 objectives and those for Q2 agreed,” OTA2 said. “A suite of Business KPIs has been developed, which have identified some key variances with industry as a whole, which are now being collaboratively analysed for root cause and to develop appropriate service improvements.”

In other news OTA2 reported that there were 9.02 million unbundled lines, 6.15 million WLR lines and 2.15 million numbers using CPS.

BT’s broadband rip-off – the evidence

Credible evidence that BT is charging more than double what it should for wholesale superfast broadband products has probably prompted national regulator Ofcom to investigate a complaint that BT is conducting an illegal margin squeeze.

The evidence is contained in a confidential report commissioned by TalkTalk, currently the biggest user of BT’s local loop unbundling (LLU) products, which made the complaint.

Ofcom presently does not regulate BT infrastructure provider Openreach’s pricing for SFBB fibre products believing to do so would discourage BT’s claimed £2.5bn investment in fibre to the cabinet (FTTC). Openreach’s prices are generally meant to be very close to its costs, especially where it has ‘significant market power’, in this case, outside the Virgin Media Docsis footprint.

The 59 page report found that Openreach’s costs to build its FTTC network are £4.39 per line per month. BT Openreach charges resellers £7.40 or £9.95 depending on the bandwidth provided. Current prices for BT’s Infinity FTTC services start at £13/month and go up to £26/month. BT Retail offers discounted prices of £6.50 and £20 per month respectively for the first three months.

The report, by German telecommunications analysts Wik Consult, is a sequel to its 2012 report to ECTA, the association of European challenger carriers, that found incumbent operators price LLU access so high as to leave no money for LLU carriers to profit or invest in network upgrades or expansion. It showed that LLU had been a failure in Europe, allowing incumbent operators to retain almost 100% of the market.

“At the prices charged for copper, all the cash flows have gone to the incumbent, and entrants have been persistently cashflow negative,” Wik reported, adding the same might become true for access to fibre-based products unless regulators stopped it.

For its report to TalkTalk, Wik modelled Openreach’s costs based on publicly available information. It found the main factors that affect its costs are penetration (take-up of GEA on the FTTC platform), the weighted average cost of capital (WACC) including any risk premium applied to NGA, the extent to which existing ducts can be reused for the installation of fibre between the street cabinet and local exchange, the depreciation method and asset lifetimes.

It checked the results produced by its base model and sensitivity tests against BT’s own statements and evidence from more developed markets in Europe. The checks suggest Wik’s assumptions and conclusions are conservative.

In particular, it suggests that 65% of non-Virgin Media SFBB subscribers will take up an service provided using Openreach infrastructure. Active electronics had a life span of eight years, cabinets and fibre 20 years each, and ducts 40 years, it said.

Almost two years ago Kevin McNulty, Openreach’s general manager for next generation access commercial partners, told Br0kenTeleph0n3 BT’s NGA financial plan was based on a break-even period of 10 to 12 years and a 20% take-up.

For the record, Ofcom announced on 1 May that it would investigate a complaint from TalkTalk Group that alleged BT has been conducting an illegal “margin squeeze” on wholesale access to Generic Ethernet Access (GEA), BT’s FTTC product.

Ofcom said the complaint alleged abuse of “a dominant position in breach of (regulations) in relation to the supply of superfast broadband (‘SFBB’). Specifically, (TalkTalk) alleges that BT has failed to maintain a sufficient margin between its upstream costs and downstream prices, thereby operating an abusive margin squeeze.”

Ofcom said it could investigate such allegations if it had “reasonable grounds” for suspecting a breach.

TalkTalk said in a statement, “We have long maintained that there needs to be tighter regulation in superfast broadband to ensure a level playing field and therefore deliver real benefits for consumers and businesses. We are pleased that Ofcom is taking this matter seriously and have decided there is reasonable suspicion to investigate BT’s fibre pricing.”

BT said it was “disappointed” by Ofcom’s decision.

Ofcom expects to report its initial findings towards the end of the year. It will decide then whether or not to proceed.